With over 40 million users, Cash App is very popular in the United States. And the main reason – it does not discriminate against people who don’t have or don’t want to give away their sensitive information like social security numbers (SSN).

It is straightforward if you want to know how to use Cash App without SSN. Just download the app, skip the financial information, and start using it immediately!

What is Cash App?

Cash App is a modern mobile payment system for easy and convenient transactions. Square Inc. created the Peer to Peer payment app in 2013 to compete with similar applications like Venmo, PayPal, Apple, and Samsung Pay.

You can send or receive money, stocks or cryptocurrency without leaving the app. Cash App also lets you set up a bank account and order a Cash Card from the phone.

With early paycheck direct deposits, zero-cost ATM withdrawals, bills pay, instant discounts, and boosts on purchases, Cash App is an all-in-one financial app. It takes care of almost all of your needs.

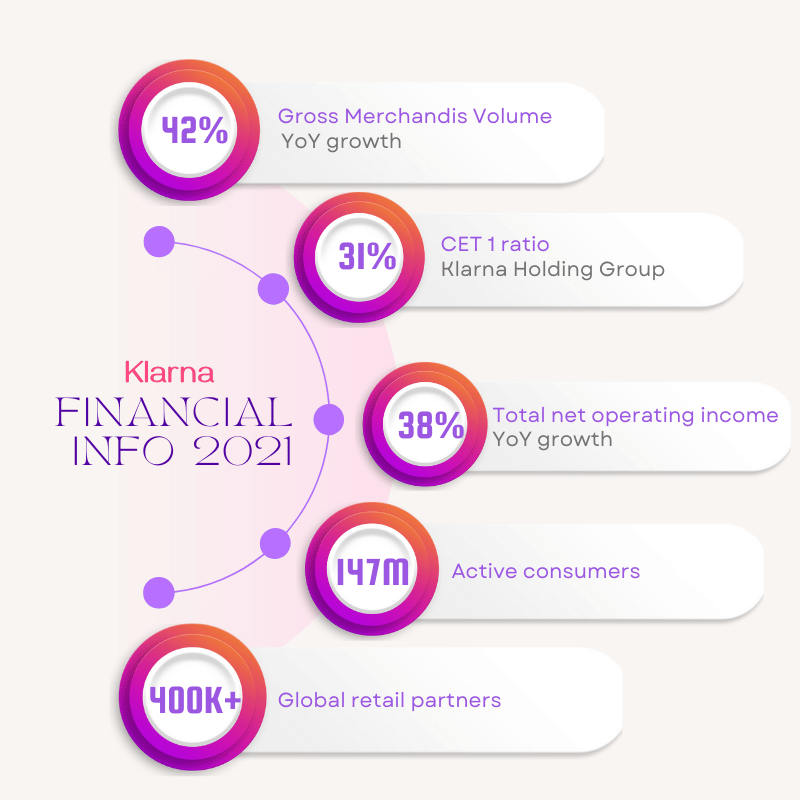

Cash App Facts/ Stats

The company reports that the Cash App’s network is the primary driver of customer acquisition in its 2021 fourth-quarter reporting.

Cash app generated $12.32 billion of revenue and $2.07 billion of gross profit in 2021. It is a 106% and 69% increase year over year. The app generated $1.96 billion of bitcoin revenue during its fourth quarter of 2021, equating to $10.01 billion yearly.

The app has over 44 million active users. The company brings in a $47 gross profit with an expense of $10 in customer acquisition per transacting active user. The platform also experienced increased customer engagement among existing customers showing positive signs of retention.

The Cash App’s subscription service was also a big hit. Its subscription and service-based revenue generated $487 million during its fourth quarter of 2021 and a total of $1.89 billion for the entire year. It is a 63% increase compared to 2020.

Cash App User Sign Up

To become a Cash App user, you must first download the app from Apple App Store or Google Play Store on your mobile device. Once downloaded, you’ll receive a step-by-step guided sign-up process when you open the app.

Since it is a mobile app, you’ll need a phone number where you can get a text message. Alternatively, you can create a Cash App account with an email address.

The app will send you a confirmation number to proceed to the next step. It will request to provide the debit card information to add bank details. You can skip this step to move on to adding your personal information, like your First and last name.

You’ll choose a $cashtag that will act as your account ID. Next, you’ll add your zip code; voila, you just created a Cash App account.

Unverified Account Limitation

Once you create the Cash App account, you can receive money through $cashtag. You send a payment request using the Cash App request option utilizing a username, $Cashtag, phone number, or email address.

You can receive only up to $250 within seven days with an unverified cash app account. Unverified accounts are also limited to spending $1,000 within any 30 days. A verified account enables you to send up to $7,500 per week.

You can send the payment through Cash, Gift Cards, Stocks, or Bitcoin.

Account Verification

There are several reasons you’d want to verify your Cash App account. Besides raising the sending and receiving money limits, you must verify your account to receive a Cash Card, buy and sell Bitcoins or invest in stocks.

Cash App is a legit business, but there are many reports of fraudulent activities like identity theft and Cash App scams. The app is secure, but users must take steps to keep their login credentials confidential.

You can verify your account using your full name, date of birth, mailing address, and last four digits of your Social Security Number. Cash App may request additional information if it cannot verify through the provided information.

Does Cash App ask for an SSN?

You do not need a Social Security Number (SSN) to use the Cash app. It requires the last four digits of your SSN to verify accounts.

Cash App will only ask for an SSN for account verification.

How to Safely use a Cash App without SSN?

Cash is a regulated financial institution and must abide by the U.S. Federal government and application laws. The U.S. Financial Crimes Enforcement Networks (FinCEN) made it mandatory for the customer and financial institutions to comply with the KYC standard. Therefore the Cash App requires SSN account verification. However, you can use the app without SSN.

You can sign up for Cash App and start using the app immediately without entering SSN information. Cash App will tag you as an unverified user, but you’ll be able to use its essential features like sending and receiving money. Cash App limits your daily or monthly transactions, but you can perform transactions within the limit.

Benefits of a Verified Account

It would help if you took advantage of many benefits with a verified Cash App account. Besides protecting customers from illegal activities and money laundering, Cash App wants to keep your account secure. It is one of the largest Peer- to Peer payment apps that takes customer privacy seriously.

Here are some of the benefits of a verified Cash App account.

Increase transaction limit

A verified Cash App account gets an increase in its daily or monthly cash transfer limits. You can send up to $7,500 per week and up to $17,500 per month. You will also be eligible to receive an unlimited amount.

Loading the Account

Cash App has participating retailers like Walmart, Walgreens, Family Dollar, and many others, where you can deposit paper money into your Cash App balance. You can find a convenient deposit location through the app. The deposit limit is $1,000 per rolling seven days and $4,000 per rolling 30 days. And your deposit range must be $5 to $500.

You can also receive up to $25,000 per direct deposit and up to $50,000 in 24 hours.

Tax Returns

Cash App offers a free tax filing service with free audit defense on every tax return. No matter your tax situation, Cash Apps lets you e-file your return at no cost.

And it is not inferior to other commercial tax software.

You can file using your app on the phone or file from the computer. The platform can also automatically grab information from the W-2 snapshots. You will receive the refunds directly in your Cash App account.

Cash App also makes it easy for the business to receive tax documents. The platform will provide you with Form 1099-B based on Form W-9 information.

Buy/Sell Stocks and Crypto

Cash App makes it easy to buy and sell stocks and cryptocurrency. You can invest as little as $1 and own fractional shares of giant companies. The platform does not have fees and commissions and provides free investment insights, analytics, and reports. You can select to invest manually, set up a scheduled investment, and even gift stocks to friends and families.

Bank Deposit

The cash app offers users a free bank account number through its bank partners. The setup is easy, and you can request a debit card. Cash App uses FDIC-insured Lincoln Saving Bank as its financial institution that offers no monthly fees and no overdraft fees.

Although the system does not allow wire transfers, you can transfer funds from your debit Card into the bank and vice versa. The money transfers to the bank accounts are available within 1-3 business days. Instant deposits to a debit card are available immediately.

Cash Card

Cash Card is a free debit card that Cash App offers, which works everywhere that accepts visa cards. The Cash App Card is linked to your Cash App balance. You can load up the customizable card in Apple Pay or Google Pay for digital payment. You can also use the visa debit card for ATM withdrawals.

One of the significant benefits of using a Cash Card is the cash boost. It allows you to get instant discounts at your favorite restaurants, coffee shops, or other online or physical businesses.

Wrapping Up

Cash App provides a convenient P2P payment solution to send and receive money. Its additional services include Cash cards, cash boost, stock and crypto investments, filing tax returns, and an online banking facility.

Anyone without divulging their social security number (SSN) can use the app and make transactions. But it comes with limitations. A detailed Cash App’s features are available to those who verify their account.